https://rtfinancialgroup.com/wp-content/uploads/2024/04/Back-view-portrait-of-blonde-female-doctor-sitting-at-desk-in-office-working-with-computer.jpg

1250

2000

Abstrakt Marketing

/wp-content/uploads/2023/03/Round-Table-Financial-Logo-Transparent-White-V2.png

Abstrakt Marketing2024-04-15 06:21:072024-05-05 12:23:24Why You Should Use Medical Factoring as a Healthcare Staffer

https://rtfinancialgroup.com/wp-content/uploads/2024/04/Back-view-portrait-of-blonde-female-doctor-sitting-at-desk-in-office-working-with-computer.jpg

1250

2000

Abstrakt Marketing

/wp-content/uploads/2023/03/Round-Table-Financial-Logo-Transparent-White-V2.png

Abstrakt Marketing2024-04-15 06:21:072024-05-05 12:23:24Why You Should Use Medical Factoring as a Healthcare StafferThe Evolution of AR Financing and How to Improve Your Cash Flow

Accounts receivable financing (AR financing) has significantly evolved, moving from a traditional tool for capital generation to a modern, digital solution that offers instant cash flow and flexible financing amounts. This evolution has brought both benefits and drawbacks.

Keep reading to explore AR financing and discover how to leverage it for your business.

Understanding AR Financing

AR financing is a vital strategy for improving liquidity and cash flow management. It allows businesses to convert outstanding invoices into immediate cash, helping them cover short-term expenses without waiting for customer payments. This financing arrangement is especially critical for bridging the gap between delivering products or services and receiving payment. It’s utilized across various industries, enabling companies to free up working capital tied up in unpaid invoices and sustain operations.

The Evolution of AR Financing and Its Impact on Businesses

The journey of AR financing from simple ledger entries to advanced digital platforms has significantly increased its importance for modern businesses. This evolution has made it a cornerstone in managing liquidity, contributing to working capital management, supply chain facilitation, and strategic procurement. As AR financing has adapted to the digital age, it has become more integral to businesses, allowing them to maintain operational efficiency and manage cash flow effectively, even with outstanding invoices.

The Evolution of AR Financing: From Paper to Digital

AR financing has dramatically evolved. This evolution has taken us from traditional, paper-based processes to sophisticated digital platforms, significantly improving how businesses manage their receivables.

The Shift to Digital Platforms

Previously, AR financing was dominated by manual processes involving lots of paperwork and in-person discussions. These methods were time-consuming and prone to errors and delays, especially when processing invoices and determining financing amounts.

The introduction of digital platforms has changed the game. Now, businesses can enjoy automated analysis of expenditures, better management of supplier information, and opportunities for dynamic discounting. This modern approach has made the financing process much faster, more transparent, and more efficient.

Advantages of Digital Transformation in AR Financing

The move to digital platforms has brought a host of advantages:

- Efficiency and Speed – Digital solutions make financing quicker, allowing businesses to access needed cash faster.

- Accuracy – With automation comes reduced human error, leading to more accurate invoice processing and receivables management.

- Informed Decision-Making – Enhanced analytics provide valuable insights, improving spend visibility and supplier management.

This leap forward has equipped businesses with the necessary tools for better managing vendor relations and working capital, ultimately boosting financial resilience.

The Crucial Role of Technology

The backbone of this transformation is undoubtedly technology. Innovations have pushed AR financing into the future, improving every aspect, from finance management to supplier relations. AI for automated spending analysis, blockchain for secure transactions, and cloud computing for scalable solutions have made AR financing more accessible and reliable for all kinds of businesses.

The Advantages and Disadvantages of Accounts Receivable Financing

Deciding on a financing method is crucial for businesses, and understanding the advantages and disadvantages of each option is essential. AR financing stands out for its ability to manage cash flow effectively, but it’s important for businesses to carefully consider both sides before making a decision.

Advantages of AR Financing

- Immediate Access to Cash – AR financing allows businesses to quickly obtain the working capital they need, bypassing typical payment delays. This can be vital in meeting short-term financial needs.

- No Need for Physical Collateral – This financing option is particularly beneficial for service-based businesses as it doesn’t require any physical assets as security.

- Flexible Financing Amounts – Businesses can choose which invoices to finance, offering them control over the funding amount and related costs.

Disadvantages of AR Financing

- Higher Costs – AR financing offers speed and convenience, but these benefits often come with a higher price tag than traditional financing options like business loans.

- Short-Term Solution – AR financing is mainly geared toward immediate cash flow challenges and may not be the best fit for a long-term financial strategy.

- Potential Impact on Customer Relationships – When invoices are financed, businesses sometimes have to hand over control of the collections process to the financing company, which could affect how customers perceive their relationship with the business.

Discover how Round Table Financial can revolutionize your business’s cash flowthrough cutting-edge accounts receivable financing. Gain the agile, efficient financial support you need to drive growth and confidently navigate cash constraints.

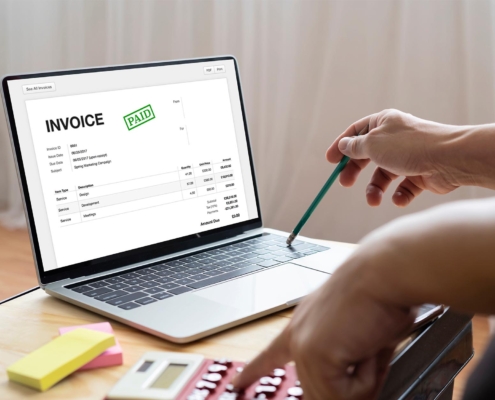

Understanding Rates and Fees in Accounts Receivable Financing

The cost associated with AR financing hinges on various factors like invoice volume, creditworthiness, financing duration, and the perceived profitability and risk by the financing entity. Central to AR financing costs are the discount or factoring fee—typically ranging between 1% and 5% of the invoice’s worth—alongside service fees for account upkeep and invoice handling.

Financing providers may also levy charges for older invoices, reflecting the heightened risk of collection efforts. The evaluation process often dives deep into a company’s assets and financial health, allowing for tailored rates that align with business needs and cash flow goals. Given the complexity of calculating these rates, understanding your business’s financial standing, including supply chain finance factors, is crucial. Effective negotiation, backed by detailed spend analysis, can help businesses secure favorable terms and lower rates.

Employing AR Financing to Enhance Cash Flow

The benefits and drawbacks of AR financing underscore its potential as a tool for improved cash flow management. By transforming receivables into upfront capital, businesses can bypass the waiting period and uncertainty tied to invoice collection. This immediate capital boost supports vital financial obligations, inventory management, and growth investments, freeing up working capital.

Enhanced cash flow positively impacts supply chain management, enabling businesses to seize early payment discounts and uphold strong supplier relations. With various AR finance mechanisms, such as factoring or selective finance, companies gain the liquidity to pursue strategic purchases and dynamic discounting, optimizing overall cash flow.

AR financing strengthens working capital management by bettering the working capital ratio—a measure of operational and financial health. This increase in available assets aids in covering liabilities, reducing the dependency on loans or other debt forms.

The Direct Impact of AR Financing on Business Cash Flow

AR financing, especially through receivable factoring, significantly bolsters a business’s cash flow by providing instant liquidity from outstanding invoices. This arrangement shortens the cash conversion cycle, empowering businesses to restock, accept new orders, invest in improvements, and expand their workforce without the usual financial hurdles. AR financing shifts the focus from chasing payments to core operational pursuits, thus driving efficiency and profit.

The acquired capital supports a range of activities, from restocking inventory to exploring R&D, ensuring the smooth operation of the supply chain and consistent business progress amidst payment delays or market variances. A notable advantage lies in the enhancement of supply chain finance. The liquidity from AR financing allows for improved supplier negotiations and trade finance opportunities, crafting a dynamic financial strategy tailored to business resilience and growth.

How to Enhance Your Cash Flow With Accounts Receivable Financing: Expert Advice

Accounts Receivable financing can significantly boost your business’s cash flow when used wisely. Expert advice can help you leverage AR financing most effectively for better financial health. Here are some key strategies:

Conduct a Thorough Spend and Billing Analysis

Before diving into an AR financing agreement, it’s essential to closely examine your spending patterns and billing cycles. A detailed analysis helps identify the best invoices to finance and the optimal timing, ensuring you maximize the cost-benefit ratio of the arrangement.

Strengthen Your Supplier Relationships

AR financing can be an excellent opportunity to improve how you manage supplier relationships. With the additional cash flow, aim to secure discounts for early payments, negotiate more favorable terms, and foster stronger collaboration with your suppliers. This not only benefits your cash flow but also solidifies your supply chain.

Select the Best Financing Partner

Choosing the right financing company is crucial. Opt for a partner with a deep understanding of your industry, offering competitive rates, low fees, and additional services that can bring extra value, such as managing supplier information and providing receivables finance consulting.

Optimize Your Receivables Management

Invest in technological solutions to streamline your receivables process. Efficient invoice processing, automated reminders, dynamic discounting, and quick dispute resolution can all help ensure faster collections and reduce the time it takes your business to turn sales into cash (Days Sales Outstanding or DSO).

Make Data-Driven Decisions

Use the insights gathered from your AR financing activities to inform your decision-making. Analyzing data related to spending, outstanding invoices, cash flow projections, and working capital ratios can offer valuable insights for strategic financial planning and operational improvements.

Accelerate Your Business Growth With Round Table Financial

Round Table Financial is a committed ally for businesses that need a boost in their cash flow and are looking to quickly access the working capital they need without the long wait for customer payments. We specialize in invoice financing or factoring, buying your outstanding invoices at a reduced rate, giving you up to 90% of the amount almost immediately. This way, you can quickly get back to focusing on growing your business, covering expenses, or making payroll without the complications that often come with traditional loans. Our process is designed to be straightforward, quick, and customized to your needs, guided by our team of experts every step of the way.

Ready to get the financing you need to stay nimble and competitive? Reach out today.

Share This Post

More Like This

https://rtfinancialgroup.com/wp-content/uploads/2024/04/Back-view-portrait-of-blonde-female-doctor-sitting-at-desk-in-office-working-with-computer.jpg

1250

2000

Abstrakt Marketing

/wp-content/uploads/2023/03/Round-Table-Financial-Logo-Transparent-White-V2.png

Abstrakt Marketing2024-04-15 06:21:072024-05-05 12:23:24Why You Should Use Medical Factoring as a Healthcare Staffer

https://rtfinancialgroup.com/wp-content/uploads/2024/04/Back-view-portrait-of-blonde-female-doctor-sitting-at-desk-in-office-working-with-computer.jpg

1250

2000

Abstrakt Marketing

/wp-content/uploads/2023/03/Round-Table-Financial-Logo-Transparent-White-V2.png

Abstrakt Marketing2024-04-15 06:21:072024-05-05 12:23:24Why You Should Use Medical Factoring as a Healthcare Staffer

A Complete Guide to Understanding Construction Invoice Factoring

Invoice Factoring

What Is a Factoring Company?

Invoice Factoring

The Evolution of AR Financing and How to Improve Your Cash Flow

Invoice Factoring

How to Effectively Manage Unpaid Invoices

Invoice Factoring

Common Cash Flow Problems and Solutions for Businesses

Invoice Factoring

How to Approach Budget Review for Small Businesses

Invoice Factoring

Finding the Best Invoice Factoring Company: What to Look For

Invoice Factoring

Invoice Factoring Pros and Cons

Invoice Factoring

Round Table Financial is a responsive team of funding experts ready to cut you a straight path to immediate cash flow solutions.

Stay Connected

- Link to Facebook

- Link to Twitter

- Link to LinkedIn

Link to LinkedIn

- Link to Instagram

Link to Instagram